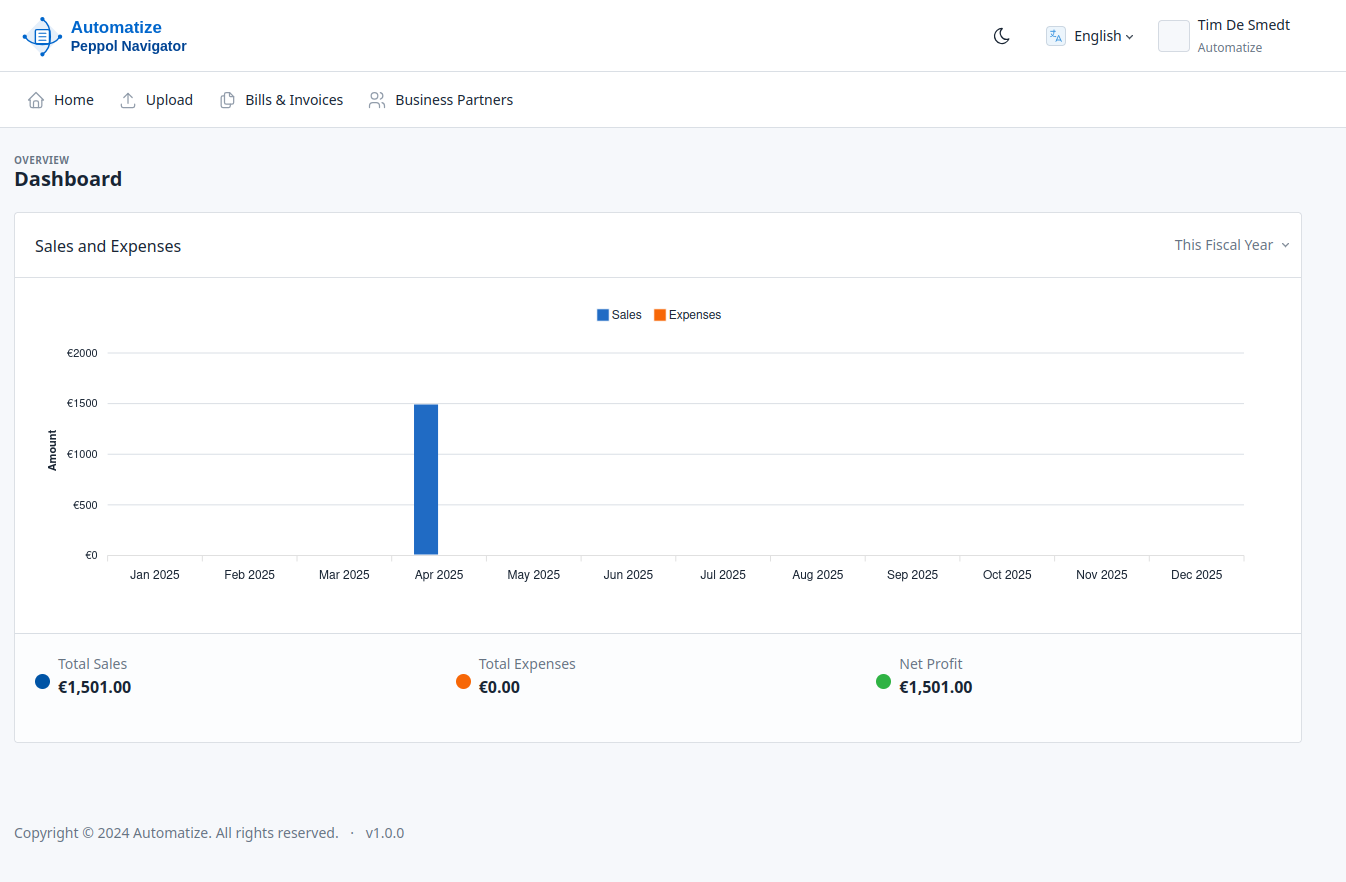

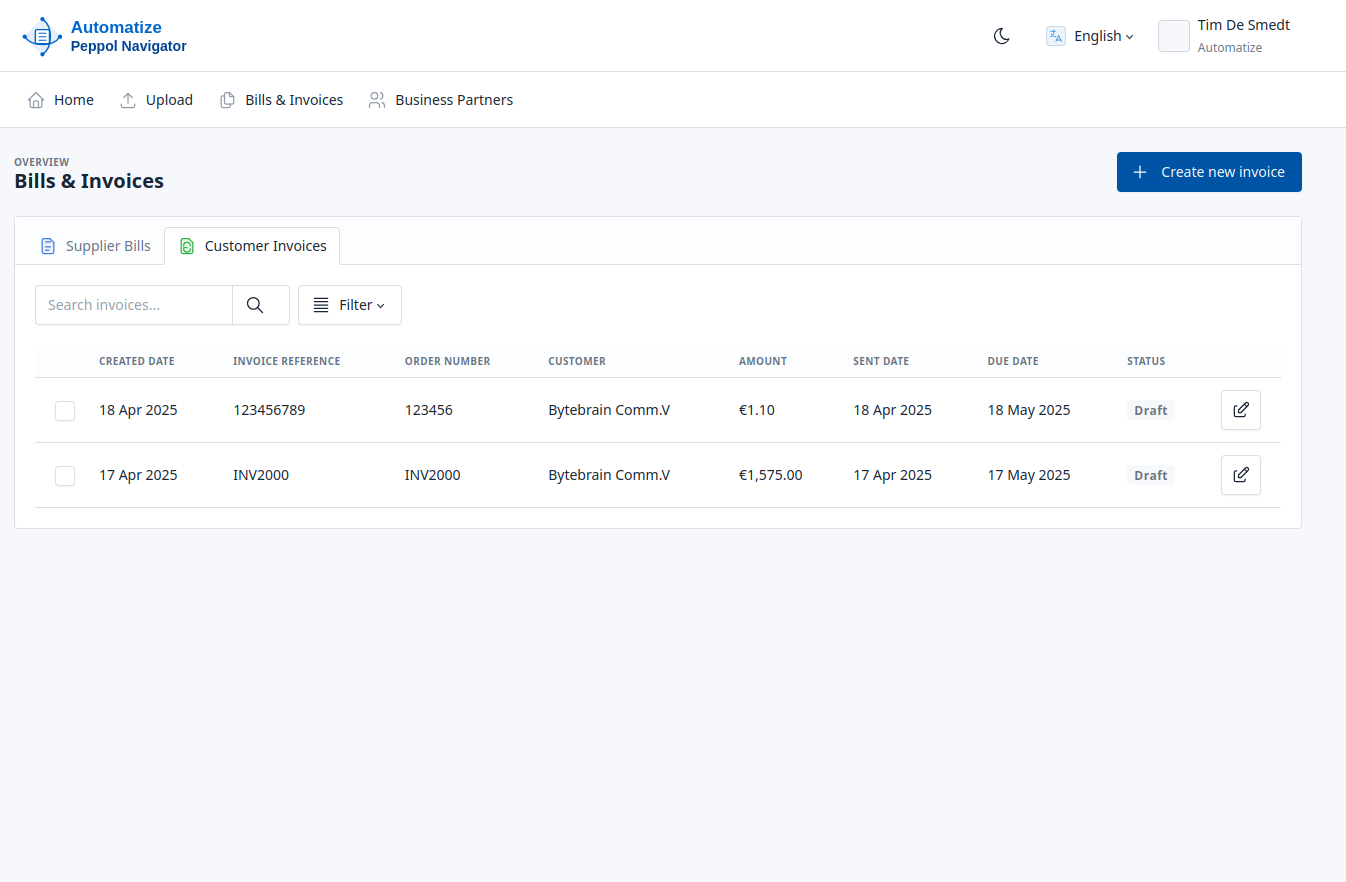

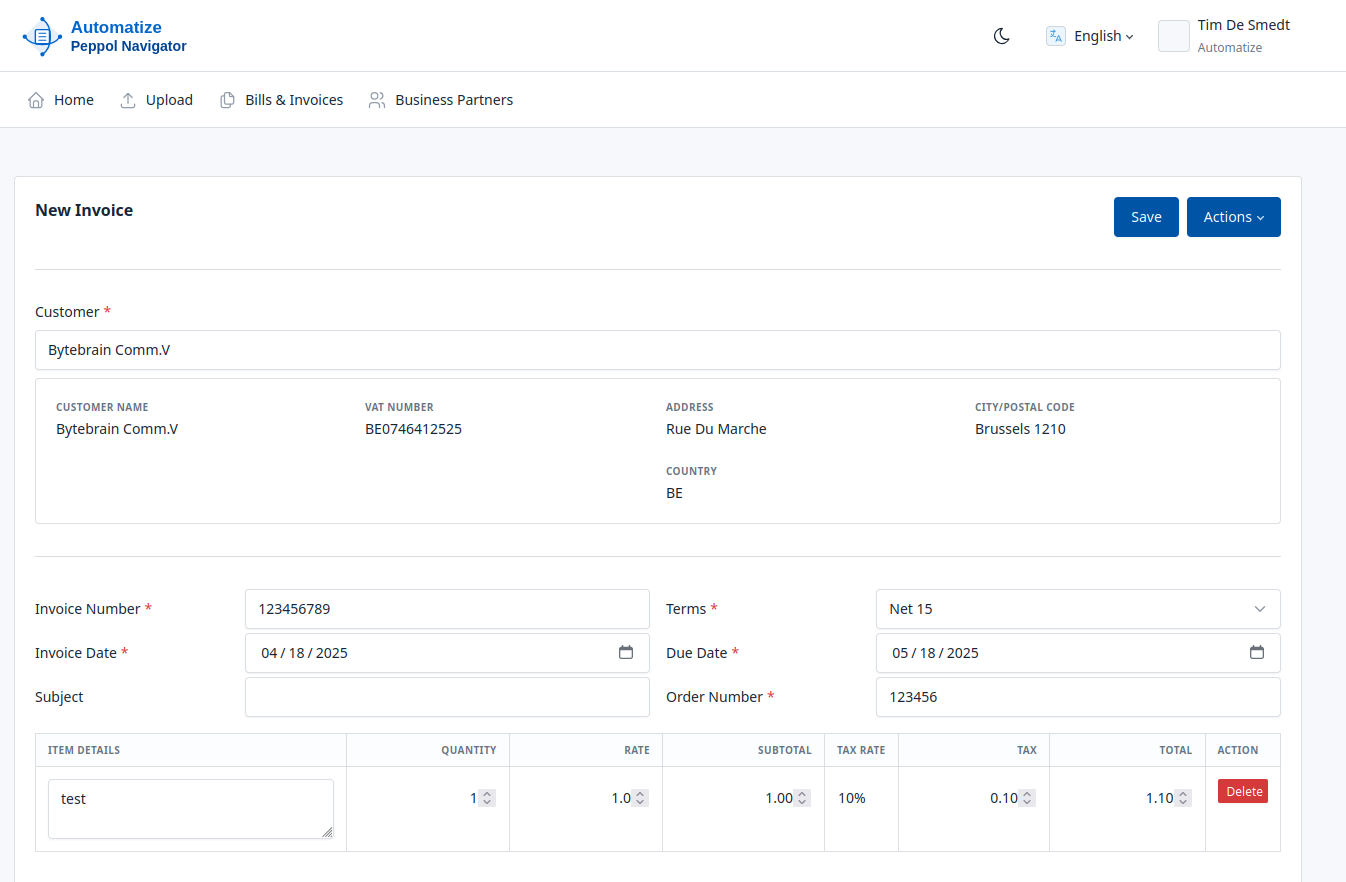

Simplify Your Peppol E-invoicing Journey

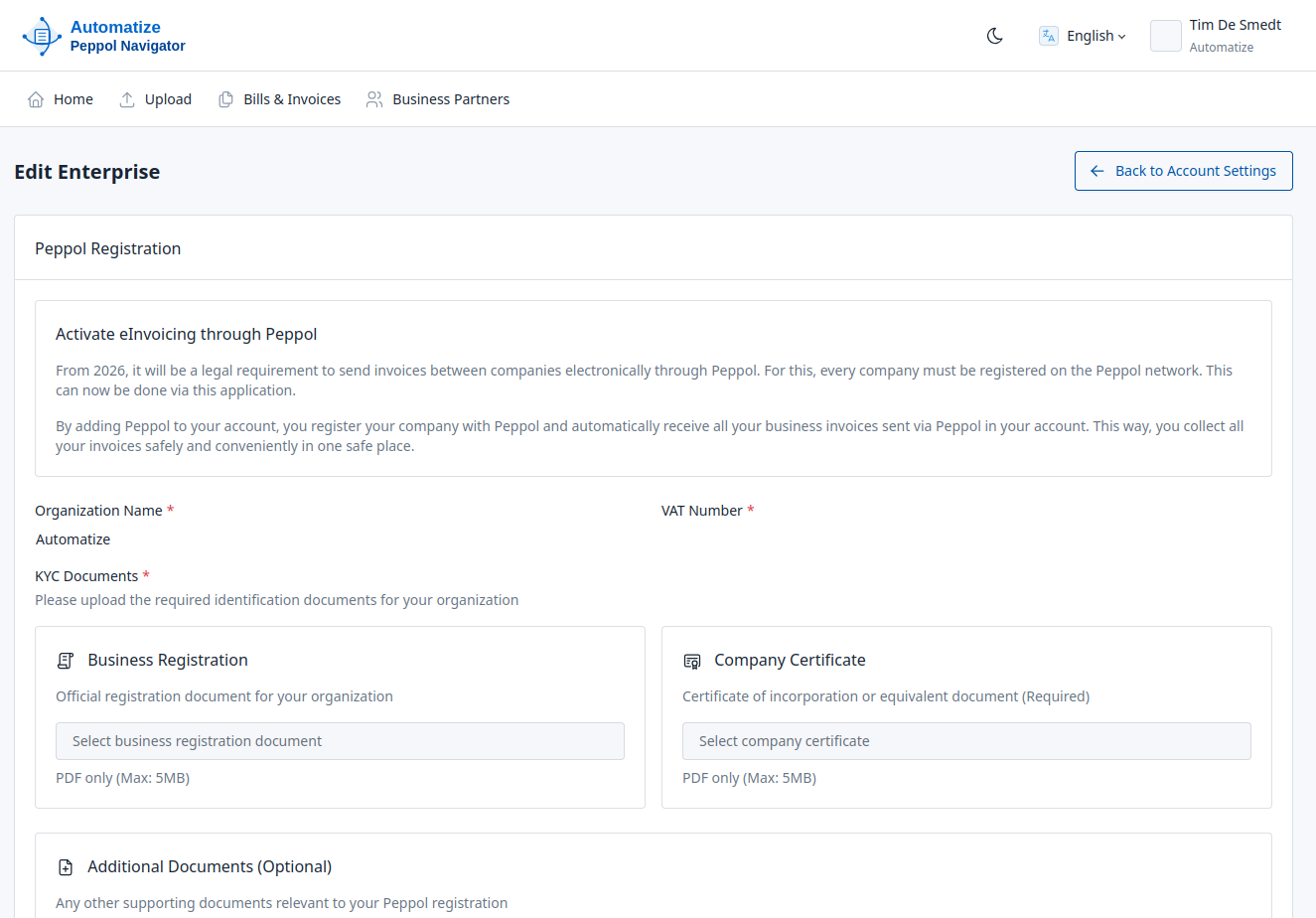

PeppolNavigator helps businesses smoothly navigate the Peppol network, manage connections, and streamline e-invoicing processes with ease and confidence.

What's Changing for Businesses and Self-employed Individuals?

Major changes are coming to how organizations handle invoicing. Here's what you need to know.

⚠️ Important: Mandatory from January 1, 2026

Every VAT-registered business and self-employed person doing business with another VAT-registered company must send and receive e-invoices via the Peppol network. This means:

- No more sending invoices as PDF or on paper

- You need software that supports Peppol and can process invoices

Only for B2B Transactions

The obligation to digitally invoice only applies to transactions between VAT-registered companies (B2B). Invoices to individuals (B2C) are not covered by this obligation.

Small Business VAT Exemption?

Even if you use the VAT exemption scheme for small businesses (turnover < €25,000), you must still send your B2B invoices digitally from now on.

Government Contractors

Working with government institutions? You're already required to send e-invoices via Peppol.

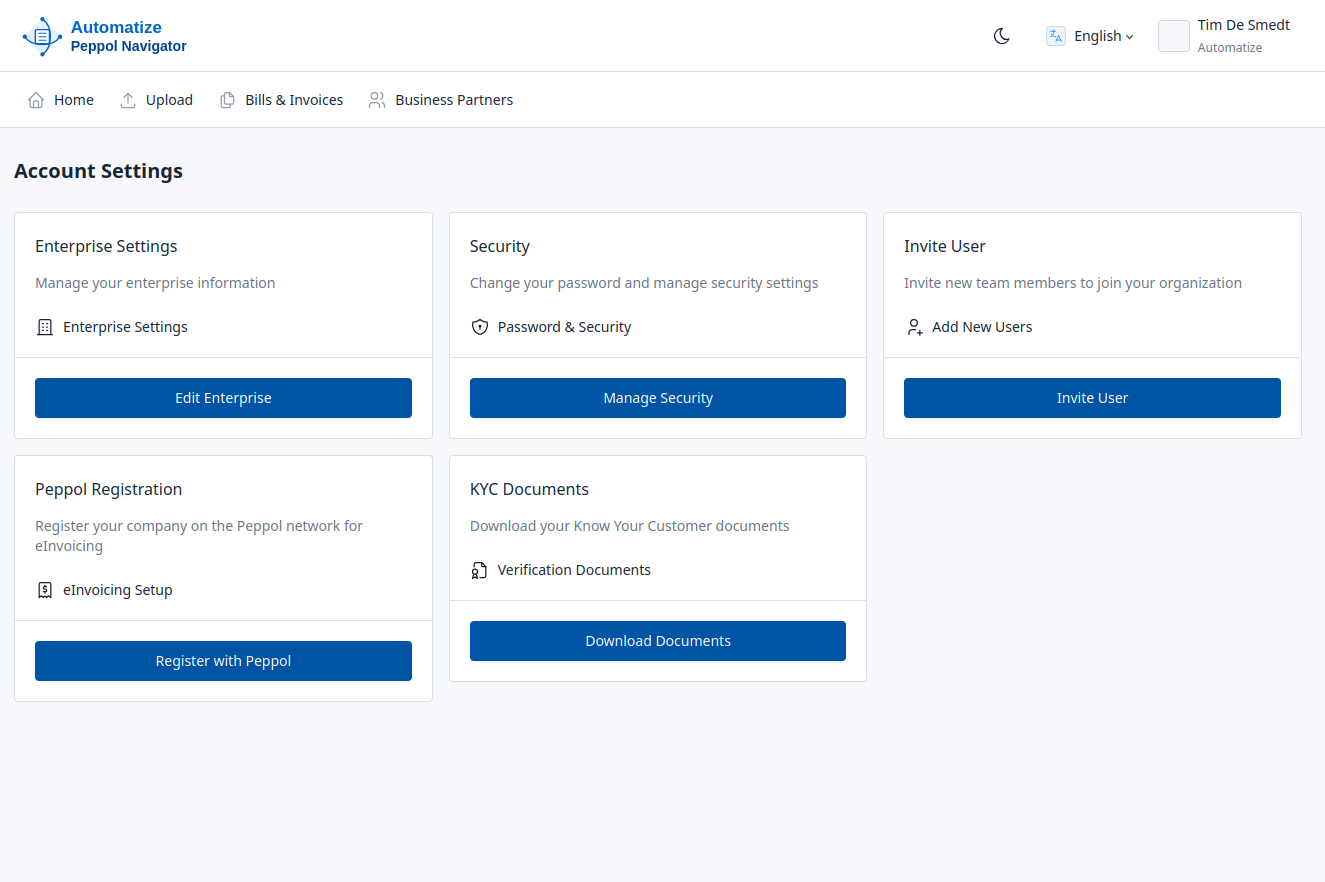

How Does the Peppol Network Work with PeppolNavigator?

Understanding how PeppolNavigator simplifies your e-invoicing journey through the Peppol network

Send & Receive

Invoices

Automatic

Processing

What Are the Benefits of E-invoicing?

The government wants to make invoicing more efficient, transparent, and secure.

E-invoicing means that invoices are processed in a structured and error-free manner, without having to manually enter them into your accounting. This offers many advantages:

- Less administration: Everything is processed automatically, saving you time

- Fewer errors and ghost invoices: Invoices are read directly by software, without risk of typing errors

- Faster payments: Customers receive your invoices immediately and can process them faster

- No worries about compliance: You automatically comply with legal obligations

- Safer (digital) business

- Easy international invoicing

What Does This Mean Practically for Your Business?

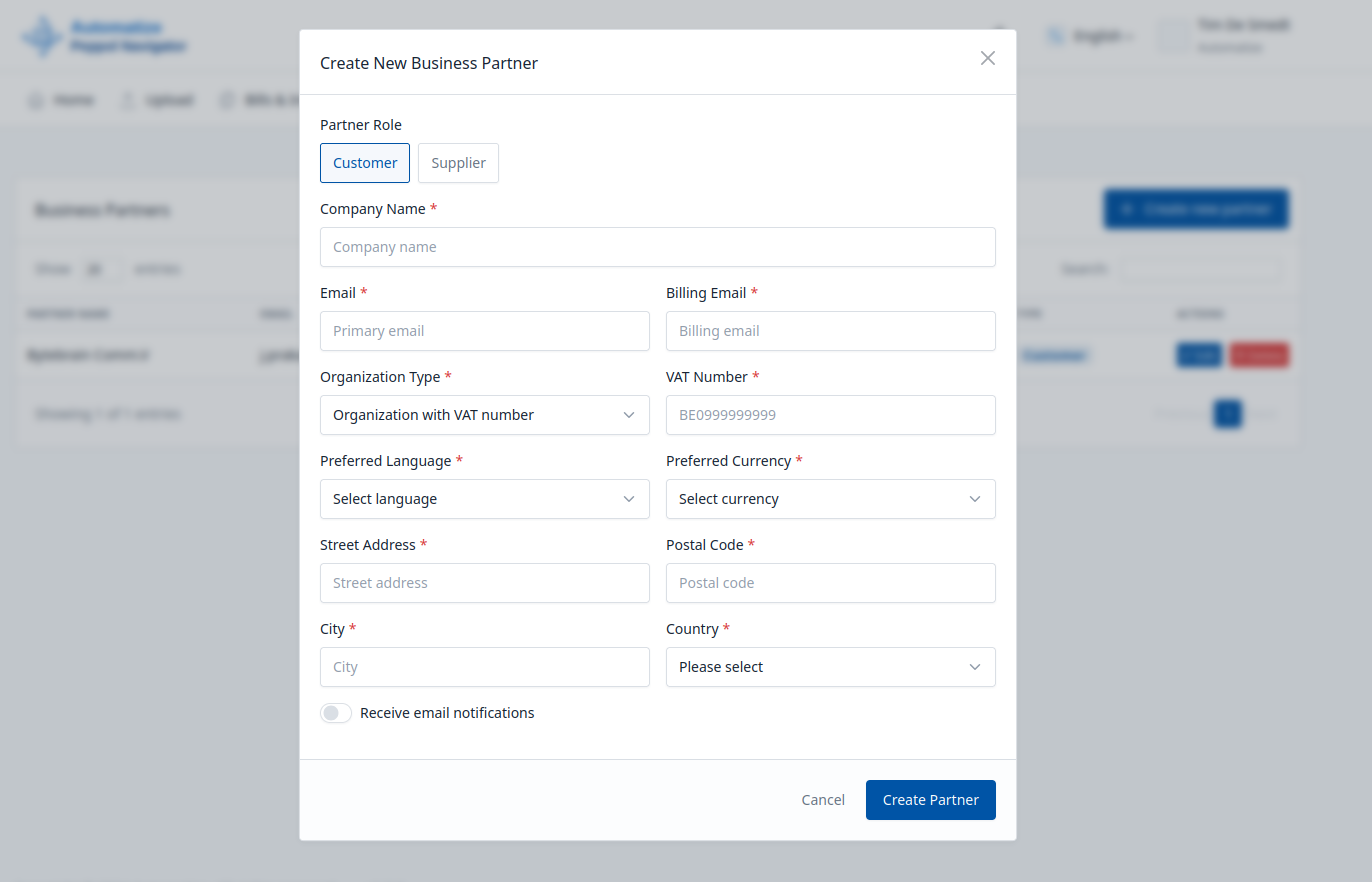

Whether you run a large company or are self-employed, you can choose how to approach this, depending on your current way of working.

💡 Tip: Always Stay in Control of Your Digital Mailbox

When registering on the Peppol network, you remain in control of your own archive. Regardless of whether you work with an accountant or not, be sure to choose invoicing software that is compatible with all accounting packages.

Frequently Asked Questions About Digital Invoicing

Below you'll find common questions about e-invoicing via Peppol.

What is Peppol and How Does It Work?

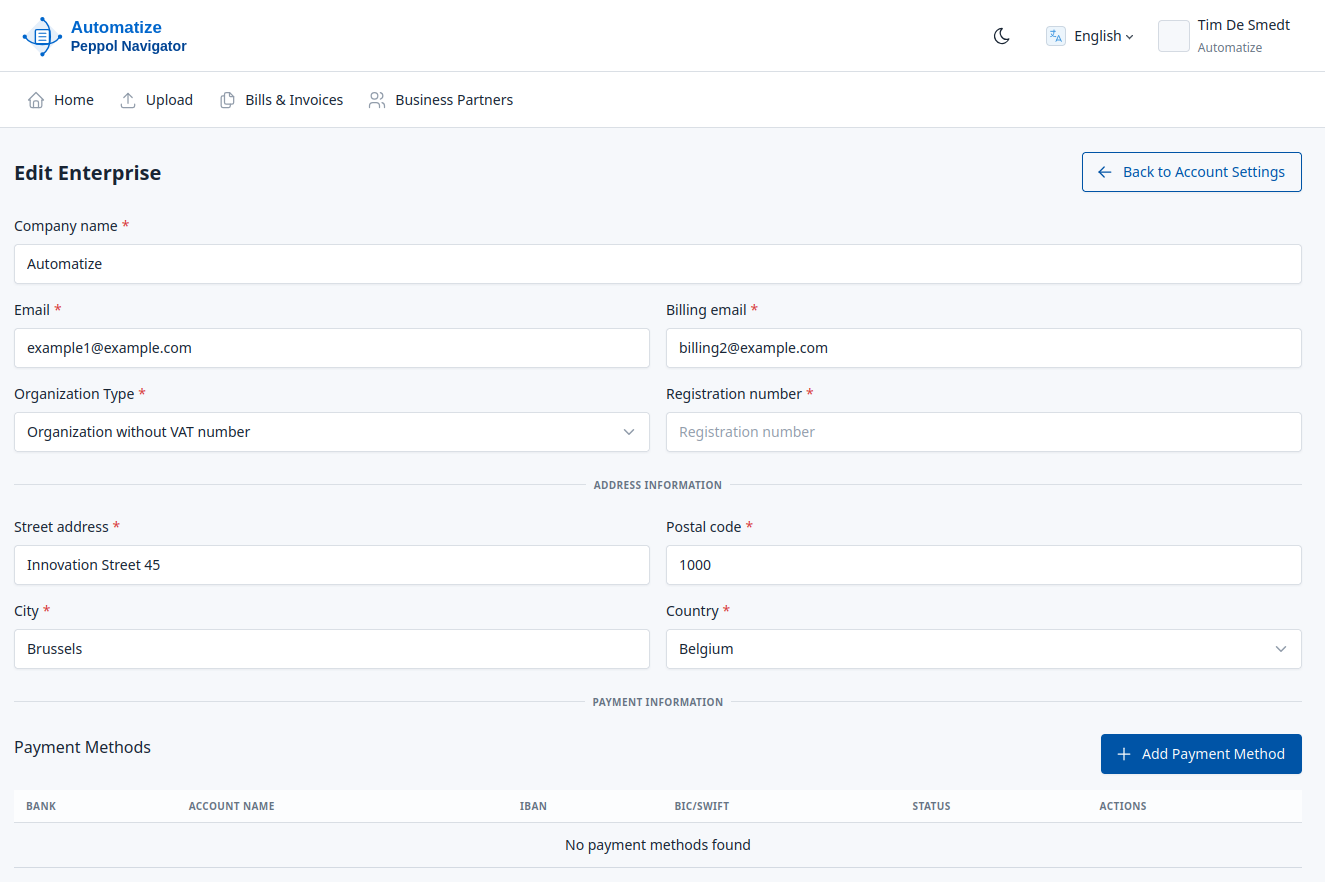

Peppol is a European network that allows businesses and governments to exchange electronic invoices securely, standardized, and efficiently. It will become mandatory in Belgium from January 1, 2026 for all B2B transactions.

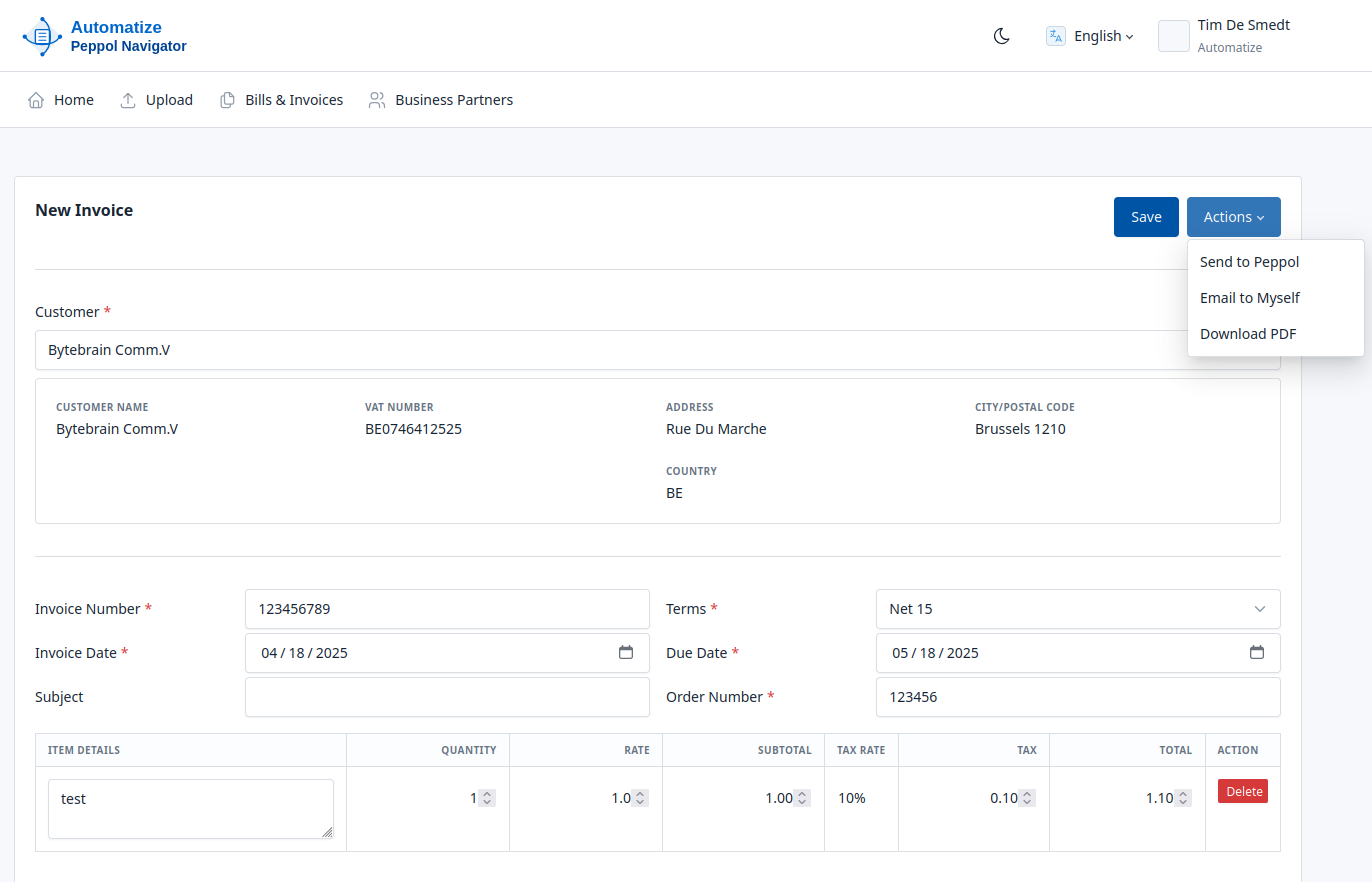

Via your invoicing software with a linked Access Point, invoices are automatically sent and received in a standardized format.

An Access Point is the digital channel within your software that sends your invoices to the Peppol network and receives invoices from others.

The use of the network itself is free, but the software to send and receive invoices is paid.

Unlike proprietary e-invoicing solutions or EDI systems that require custom setups for each trading partner, Peppol provides a standardized "connect once, reach all" network. Once you're connected to Peppol, you can exchange documents with any other Peppol participant without additional setup. Peppol also ensures compliance with standard formats, security, and legal requirements across multiple countries.

Peppol stands for "Pan-European Public Procurement Online." Although it originated for European public procurement, Peppol has expanded globally and now supports both public and private sector document exchange across many countries worldwide.

The Peppol network is managed by OpenPeppol AISBL, a non-profit international association based in Brussels, Belgium. OpenPeppol maintains the technical specifications, governance framework, and certification processes for the network. Individual countries have their own Peppol Authorities that handle local implementation and compliance within the global framework.

Who is Required to Use Peppol?

From January 1, 2026 for all B2B transactions between VAT-registered companies in Belgium.

No, only to other VAT-registered companies.

Yes, small businesses also fall under the obligation.

Yes, from the moment you are VAT-registered.

Yes, if they are VAT-registered.

Non-VAT-registered companies do not fall under the e-invoicing obligation.

No, as long as they are exempt under Article 44.

Software and Usage

Yes, a software package that supports Peppol is necessary. Most software uses a subscription formula (a fixed monthly or annual amount).

Yes, various providers offer free packages for limited invoicing.

Costs vary. Compare different providers.

Excel, Word and PDF will be a thing of the past from January 1, 2026. You can only use them if they can be converted to UBL formats via your software.

That depends on whether they become Peppol-ready by 2026. Check with your supplier.

Receiving Invoices

Even then you must register via Peppol to receive digital invoices.

No, from 2026 no longer for VAT-registered B2B transactions.

Via your software package that converts the invoice to a readable format.

Yes, that remains possible, usually via your software.

Foreign Invoices

No, for now that can still be done via email.

Not mandatory, consult with your accountant.

Yes, Switzerland has its own system.

Fines and Sanctions

You risk fines between €50 and €5,000.

No, but the obligation is coming.

Practical Questions

If you make purchases from VAT-registered companies, yes.

Your software indicates whether the customer is reachable via Peppol.

Not if they need to be sent via Peppol.

As long as you fall under Article 44, you are not required.

The costs associated with invoicing packages, such as subscription costs, are 120% tax deductible for self-employed people with a sole proprietorship and small companies. This benefit applies until the end of 2027.