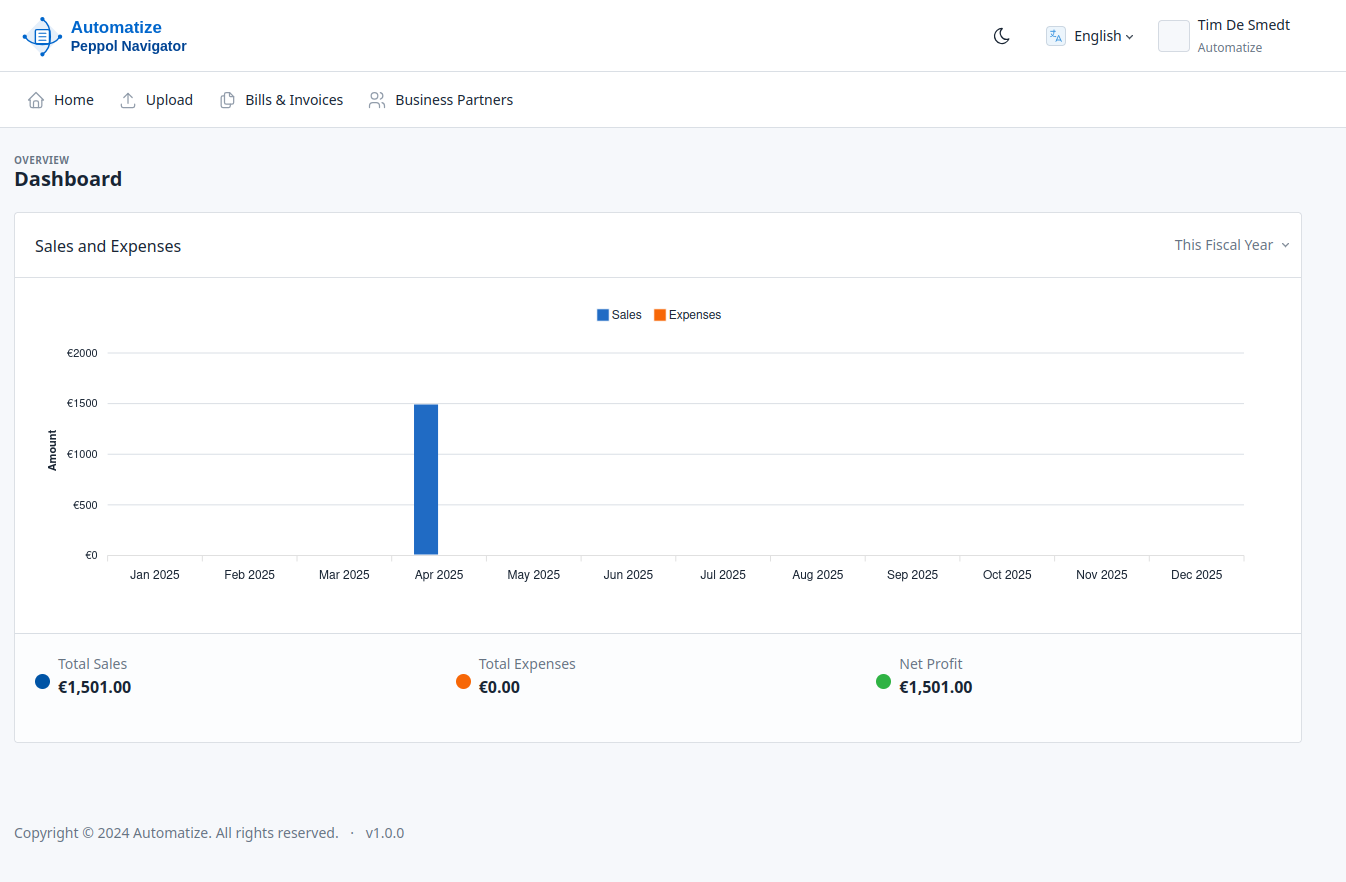

Partner with PeppolNavigator for Your Clients' E-invoicing Success

Help your clients navigate the mandatory Peppol e-invoicing requirements from January 2026. Become a trusted advisor with our comprehensive partnership program designed specifically for accountants and accounting firms.

A Major Opportunity for Accounting Professionals

The mandatory e-invoicing requirement presents a significant opportunity to expand your service offerings and strengthen client relationships.

⚠️ Important: All Your VAT-Registered Clients Will Be Affected

From January 1, 2026, every VAT-registered business doing B2B transactions must use Peppol e-invoicing. This means:

- 100% of your VAT-registered clients will need guidance and implementation support

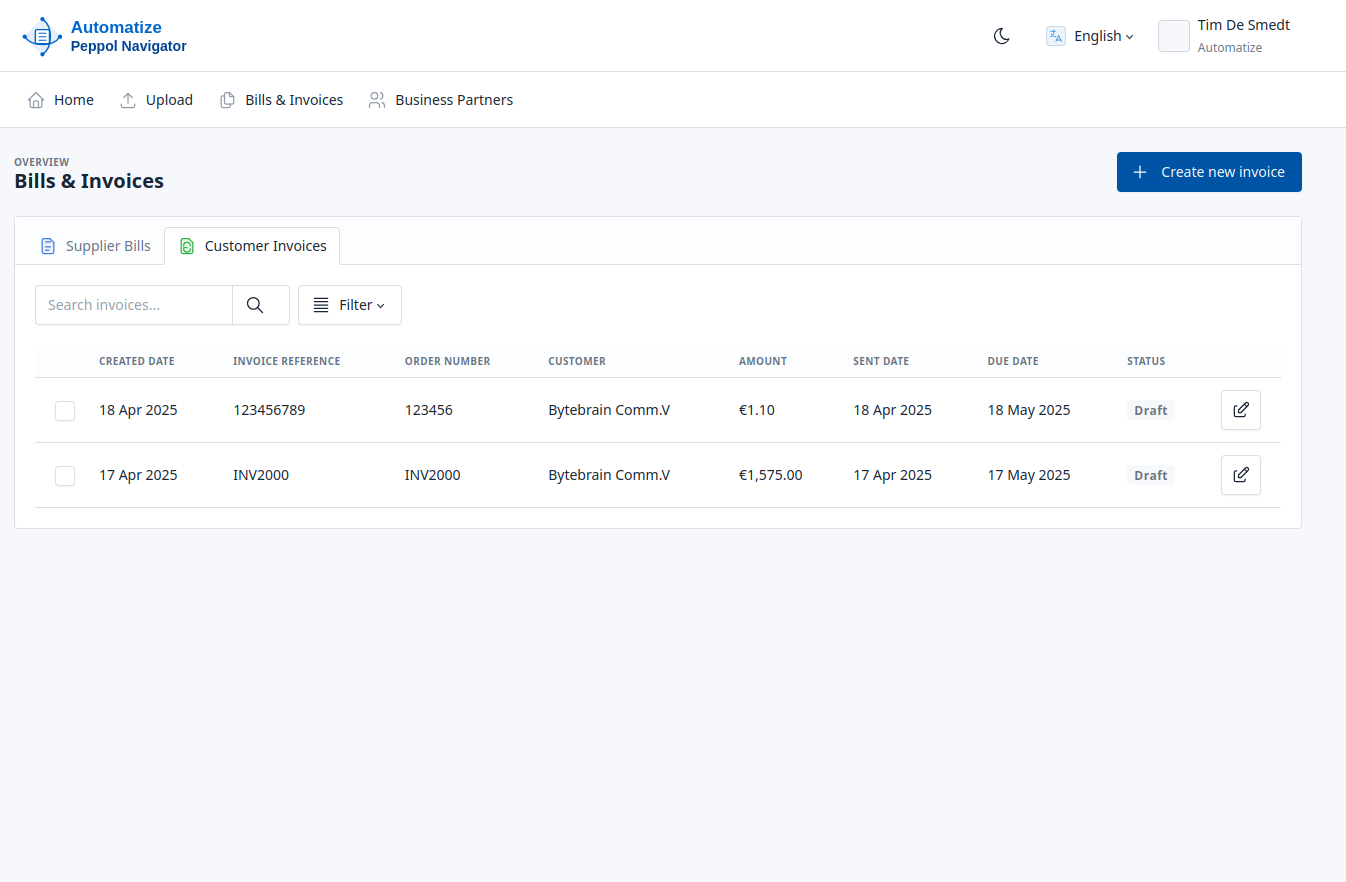

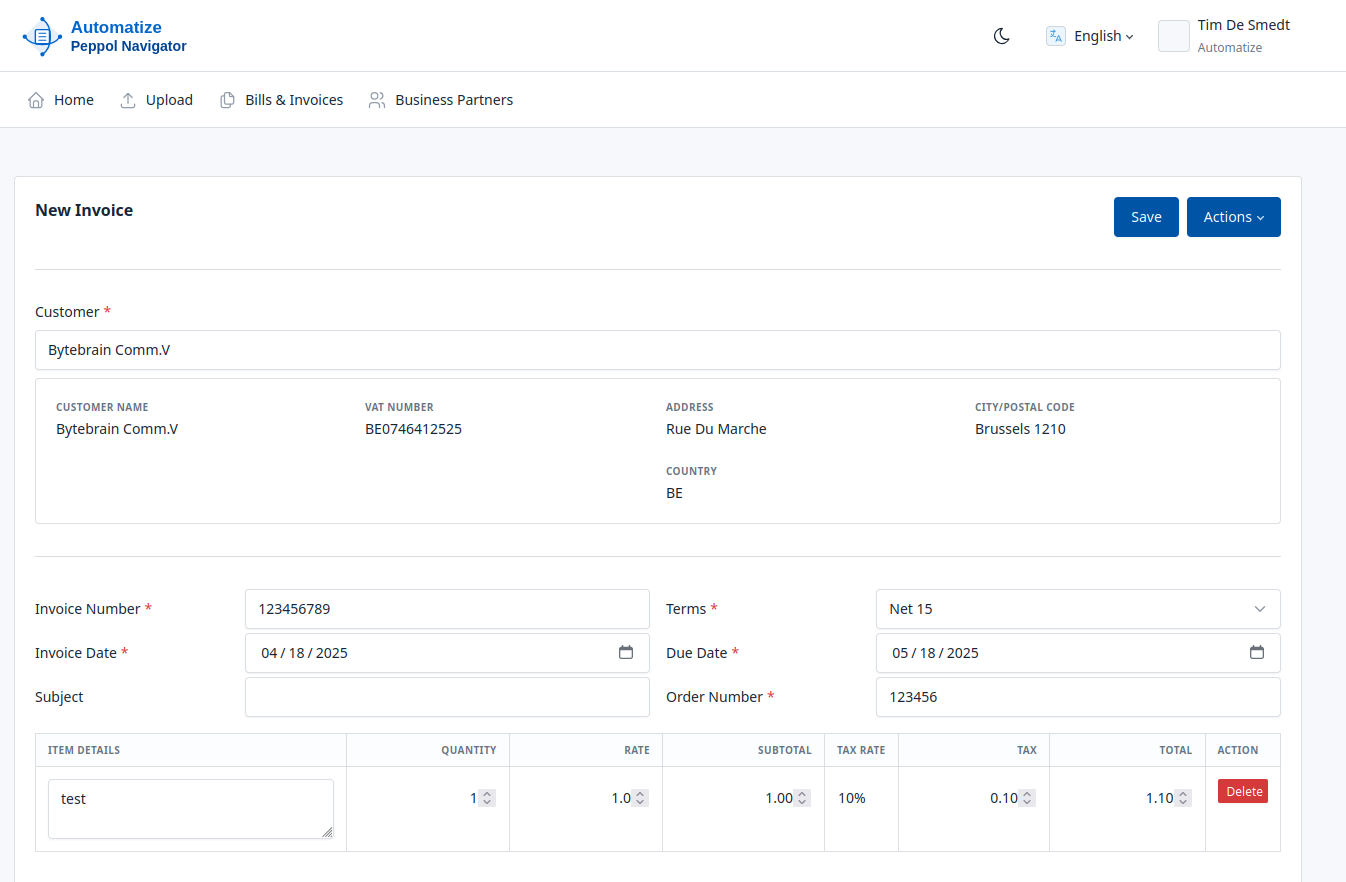

- Clients will need new software and processes - an opportunity to add value

- Non-compliance could result in fines between €50 and €5,000 for your clients

Expand Your Service Portfolio

Add e-invoicing consultation, implementation, and ongoing support to your service offerings. Position yourself as the digital transformation expert your clients need.

Strengthen Client Relationships

Guide clients through this mandatory transition, demonstrating your value as a trusted advisor and ensuring they remain compliant and competitive.

New Revenue Streams

Generate additional recurring revenue through e-invoicing services, training, and ongoing support while helping clients streamline their processes.

Benefits of Partnering with PeppolNavigator

Transform the mandatory e-invoicing requirement into a competitive advantage for your accounting practice.

By partnering with PeppolNavigator, you position your firm as a forward-thinking, digitally-savvy advisor that helps clients navigate complex regulatory changes while adding significant value to your service portfolio. Our extensive integrations with Belgian accounting software like Winbooks, King, Exact Online, and Silverfin ensure your clients can maintain their existing workflows.

- Generate new recurring revenue streams through e-invoicing services and ongoing support

- Strengthen client retention by becoming their trusted digital transformation partner

- Attract new clients who need expert guidance for Peppol compliance

- Reduce administrative burden with automated invoicing processes for clients

- Position your firm as a technology leader in the accounting industry

- Access comprehensive training and certification to become a Peppol expert

- Benefit from co-marketing opportunities and referral programs

- Gain competitive advantage over firms that don't offer e-invoicing services

How to Get Started as a PeppolNavigator Partner

Choose the partnership model that best fits your practice size and client needs.

💡 Partnership Advantage: Stay Ahead of the Competition

Many accounting firms are unprepared for the 2026 e-invoicing mandate. By partnering with PeppolNavigator now, you'll be ready to help clients before your competitors even understand the requirements. This positions you as the go-to advisor for digital transformation and regulatory compliance.

Frequently Asked Questions for Accounting Professionals

Common questions about becoming a PeppolNavigator partner and helping clients with e-invoicing.

Partnership and Business Model

Our partnership program allows accounting firms to offer e-invoicing services to their clients through our platform. You receive training, marketing support, and ongoing revenue sharing for each client you bring to the platform. We handle the technical implementation while you maintain the client relationship.

Revenue varies based on your client base size and chosen partnership tier. Typical partners see 15-25% ongoing commission on client subscriptions, plus implementation fees. With 50 small business clients, you could generate €2,000-€4,000 in additional monthly recurring revenue.

Basic partnership is free to start. Professional partnership includes optional premium training and certification programs with associated costs. All partnership tiers are designed to generate positive ROI within the first few client implementations.

Yes, our Professional Partnership includes white-label options where you can offer e-invoicing services under your firm's branding. This allows you to maintain complete control over the client experience while leveraging our technical platform.

Client Implementation and Support

Initial training requires 1-2 days. Client implementations typically take 2-4 hours per client, depending on complexity. Ongoing support is minimal as our platform handles technical issues, allowing you to focus on strategic client advisory services.

We provide full technical support, implementation guides, client communication templates, and dedicated partner support. For complex implementations, we can join client meetings or handle technical setup directly while you manage the client relationship.

All VAT-registered clients doing B2B transactions will need e-invoicing from January 2026. This includes small businesses with VAT exemption, partnerships, corporations, and non-profits with VAT registration. Only non-VAT registered entities are exempt.

We provide complete sales and educational materials including ROI calculators, compliance guides, and presentation templates. The value proposition is clear: mandatory compliance, reduced administrative costs, faster payments, and improved accuracy.

Technical Integration & Belgian Software

Yes, PeppolNavigator has native integrations with all major Belgian accounting software including Winbooks, King Software, BOB Software, Silverfin, ClearFacts, and FinanceOne. We also support international platforms popular in Belgium like Exact Online, Sage, Odoo, and Microsoft Dynamics 365.

Absolutely. We have dedicated integrations for Benelux-specialized software including Yuki, Twinfield (Wolters Kluwer), Unit4 Multivers, and Teamleader Focus. Our team understands the unique requirements of these platforms and their Belgian user base.

We can either help upgrade their existing software to Peppol-compatible versions or migrate them to our recommended solutions. This presents an additional service opportunity for your firm to manage the software transition. We provide cost-benefit analysis and migration assistance.

For clients using older versions of Winbooks, King, or other Belgian software, we first assess compatibility. Many legacy systems can be updated to support modern integrations. If not, we help with migration planning and can often maintain parallel systems during transition periods.

Yes, for clients with custom accounting systems, we offer API integration services. Our technical team can work directly with their IT departments or software vendors to establish secure Peppol connectivity while maintaining their existing workflows.

Our platform is ISO 27001 certified with enterprise-grade security, encryption, and GDPR compliance. All data is processed according to Belgian and EU data protection regulations, ensuring complete client confidentiality.

Training and Certification

Comprehensive training includes Peppol regulations, platform usage, client onboarding processes, troubleshooting, and sales techniques. Training is available online, in-person, or hybrid format to fit your schedule.

No technical expertise required. Our training covers everything you need to know. We handle all technical aspects while you focus on client relationships and business advisory services. Most partners become proficient within a week of training.

Yes, we provide regular webinars, regulatory updates, platform updates, and continuing education opportunities. Partners receive priority access to new features and advance notice of regulatory changes affecting their clients.

Competitive Advantage

Most accounting firms are unprepared for the 2026 e-invoicing mandate. By becoming a certified partner, you position yourself as a digital transformation expert, attract new clients seeking guidance, and retain existing clients through expanded service offerings.

The market is large enough for multiple partners. Early partners gain significant advantages through experience, client testimonials, and market presence. We also provide territorial considerations for Professional Partnership levels.

Yes, we have a referral program for accounting professionals who prefer to refer clients rather than implement directly. You still earn referral fees while maintaining the client relationship for your core accounting services.